Shifts in Dogecoin Transactions: A Closer Look at the Recent Surge in Activity

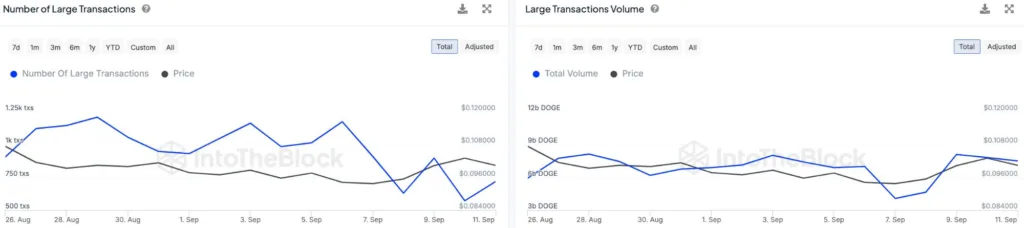

Over the past 24 hours, Dogecoin (DOGE), one of the most popular meme cryptocurrencies, has witnessed a notable shift in its transaction patterns. According to data from IntoTheBlock, the number of large transactions has surged from 571 to 717, marking an increase of 146 transactions. These large-scale movements, each valued at over $100,000, accounted for an additional $14.6 million in transaction activity.

Typically, a rise in the number of large transactions correlates with an increase in their total volume. However, what we observe here deviates from that norm. Despite a higher transaction count, the overall value of these large transactions has actually decreased over the past 24 hours. The total volume of Dogecoin involved in these transactions dropped from 7.82 billion DOGE to 7.51 billion DOGE, translating to a decrease in USD value from $806.06 million to $754.08 million.

This pattern is somewhat unusual. Although the number of transactions saw a 25.57% increase, the volume shrank by 3.96% in DOGE and 6.44% in USD. This decline points to an intriguing market development that warrants further examination.

The most plausible explanation for this phenomenon is a reduction in the average size of these large transactions. Yesterday, the average value of a large Dogecoin transaction was approximately $1.41 million, but today, that average has dropped to $1.05 million. While this represents a significant decline, it’s important to note that the average size of these transactions remains substantially higher—about ten times larger—than typical Dogecoin transactions.

Despite the decrease, the large transaction size indicates that substantial amounts of capital are still moving within the Dogecoin market. The fact that these transactions remain so sizable suggests that “whales”—the market’s major players—are still active participants, even if their behavior has shifted somewhat.

The reduction in the average transaction size could be indicative of changing market conditions or a shift in the behavior of large stakeholders. However, the continued presence of large transactions points to sustained interest from major investors in the Dogecoin ecosystem. This ongoing activity highlights the role that large players continue to play in the market’s dynamics, influencing not only transaction volumes but also overall sentiment.

In summary, while the decline in the average transaction size might signal a shift in market behavior, it is clear that significant funds continue to circulate within the Dogecoin market. The continued interest and participation of large stakeholders suggest that Dogecoin remains a critical player in the broader cryptocurrency landscape, even as its transaction patterns evolve.

Read more Musk Sparks Dogecoin Speculations Again with Playful Tweet: A Market Response

As the cryptocurrency market continues to mature, it will be interesting to see how this trend develops and whether it signifies a more profound shift in the behavior of Dogecoin’s largest investors. Whether these changes are temporary or indicative of a longer-term trend remains to be seen, but for now, the data shows that Dogecoin remains an asset of interest for high-stakes market participants.

Important Notice: The content presented in this article is intended for informational purposes only and should not be interpreted as financial advice. Coinshibainu.com bears no responsibility for any investment decisions made relying on the information contained herein. It is highly recommended to consult with a qualified expert or financial advisor before making any investment decisions.