Is Bitcoin Poised for Another All-Time High?

Recent price movements suggest that Bitcoin may be gearing up to break another all-time high. However, there’s still a long way to go. To achieve this, Bitcoin bulls must first secure a weekly close above $60,700 and push the price to $66,000 per BTC. Even then, maintaining that level for another week would be crucial before any significant breakthrough.

After bottoming out at $60,700, Bitcoin’s price has left traders somewhat perplexed. They are now eyeing two key price points—$53,000 and $66,000—as potential turning points for the near future. As we observe, the bulls appear to be in control, driving the price up by more than 3% from recent lows. However, the cryptocurrency remains stuck in a consolidation phase around the $62,000 mark, leaving traders anxious about its next move.

The Current Market Dilemma: Will Bitcoin Break $66,000?

Bitcoin recently showed signs of a promising upward trend, briefly surpassing the $62,000 level. This fueled optimism that the cryptocurrency could make a run toward its previous all-time high. Yet, the market swiftly changed direction. Instead of an immediate breakout, Bitcoin faced a series of red candlesticks, indicating a potential correction. Although the price didn’t drop significantly, it triggered a notable series of long liquidations in the market.

Despite yesterday’s promising price action, where Bitcoin briefly crossed the $62,000 threshold, the market’s direction remains unclear. The sudden shift has led to a liquidation of positions, particularly long ones, at an alarming rate.

The Impact of Liquidations in the Bitcoin Market

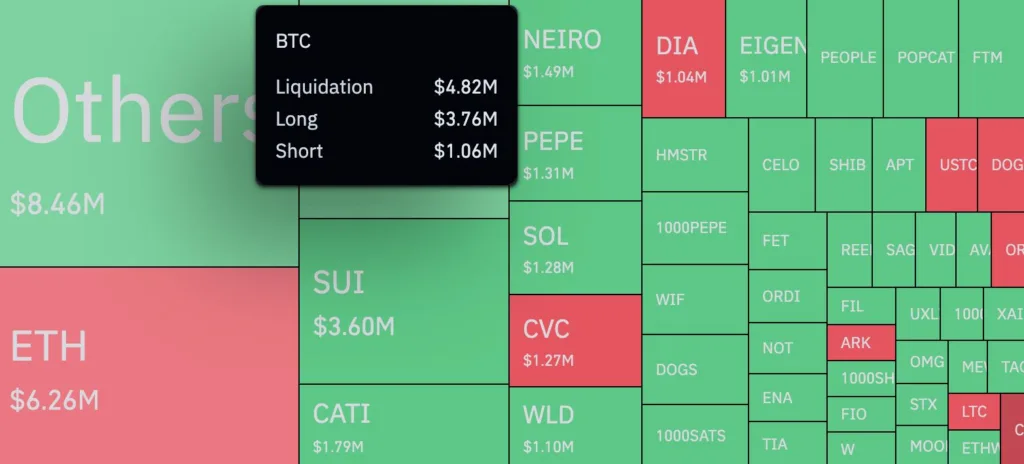

Liquidations have always been a driving force in the volatility of the cryptocurrency market, and Bitcoin is no exception. In this case, 78% of liquidations, amounting to $3.76 million, were from long positions. These positions were mostly held by optimistic traders betting on Bitcoin’s continued rise. Unfortunately, the market downturn caught many of them off guard, leading to a sudden liquidation event.

Interestingly, the liquidation was heavily skewed toward long positions, illustrating the optimism among investors about a potential price surge. The total liquidation in Bitcoin derivatives reached $4.82 million during this period. This data, provided by leading blockchain analytics firms, highlights the market’s fragility and the risks traders face when making leveraged bets on price movements.

Future Outlook: A Bullish or Bearish Market?

Looking ahead, Bitcoin’s price movements remain unpredictable. While bulls have managed to maintain a certain level of control, the market is far from stable. Traders are keenly watching the $66,000 resistance level, which could either act as a springboard for new highs or a cap that sends the price tumbling back down.

If Bitcoin manages to close the week above $60,700 and subsequently breaks the $66,000 barrier, we could see renewed momentum toward a new all-time high. However, if the market faces another round of liquidations, particularly from long positions, this could delay any upward trajectory.

Read more Unraveling the Mystery of Bitcoin’s Creator: A New HBO Series Sparks Speculation

For now, the key for traders is to closely monitor these two critical levels. A break above $66,000 could confirm a new bullish trend, while failure to maintain that level could signal further corrections. The market’s reaction to these thresholds will likely set the tone for the rest of the year.

Conclusion

Bitcoin’s journey to a new all-time high is far from certain, but recent price action has sparked renewed optimism among traders. The path to $66,000, however, remains filled with challenges, particularly in light of the recent liquidation events. With 78% of liquidations coming from long positions, it’s clear that overly optimistic traders are feeling the pinch.

As the market navigates these turbulent waters, the next key milestones to watch are the $60,700 and $66,000 levels. A decisive break above these could reignite a bullish rally, while failure to do so may trigger another round of liquidations, keeping Bitcoin stuck in its current consolidation phase. For now, patience and cautious optimism are the best strategies as traders wait to see whether Bitcoin can once again set a new all-time high.

Important Notice: The content presented in this article is intended for informational purposes only and should not be interpreted as financial advice. Coinshibainu.com bears no responsibility for any investment decisions made relying on the information contained herein. It is highly recommended to consult with a qualified expert or financial advisor before making any investment decisions.