Dogecoin’s Trading Volume Soars, But Price Struggles Amidst Market Volatility

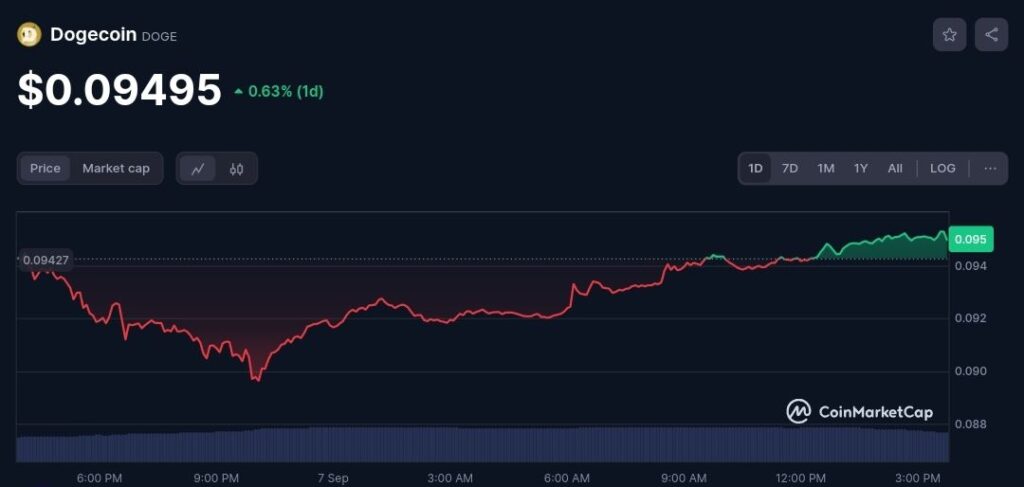

Dogecoin, one of the most popular cryptocurrencies known for its iconic dog mascot, has recently seen a significant surge in trading volume. According to data from CoinGlass, the trading volume of Dogecoin skyrocketed by an impressive 87%. However, despite this substantial increase, the price of Dogecoin (DOGE) has experienced a 5.20% decline over the past 24 hours. Over the past week, Dogecoin’s performance has been lackluster, with its price falling by more than 7% as negative investor sentiment and a broader stock market correction weigh heavily on the asset.

Earlier this week, Tesla CEO Elon Musk, who is well-known for his influence on Dogecoin’s price movements, caused a stir on social media. Musk tweeted about the freezing of Starlink’s bank accounts, prompting one of Dogecoin’s most prominent supporters to chime in, suggesting that “Dogecoin could fix this issue.” This light-hearted interaction captured the attention of the Dogecoin community, reinforcing Musk’s ongoing connection with the meme-based cryptocurrency.

Musk’s involvement with Dogecoin is nothing new. In January 2021, his statements triggered a dramatic 339% increase in the cryptocurrency’s value, pushing its price to $0.032642. Dogecoin reached its all-time high of $0.682 on May 8, 2021, largely fueled by Musk’s endorsements and widespread media coverage. Despite this, Dogecoin has struggled to gain significant traction in real-world transactions, and its use in commercial activities remains limited.

Even with Musk’s high-profile support, Dogecoin has been unable to achieve a major breakthrough in terms of long-term price stability. In recent weeks, its price has plummeted by over 7%, falling victim to the broader correction in the cryptocurrency market. The overall bearish sentiment surrounding cryptocurrencies has been particularly detrimental to Dogecoin, as it continues to face challenges in breaking past key resistance levels.

The recent drop in price has been a major blow to Dogecoin investors, particularly those who were hoping for a recovery. As the market shifts into a “fearful” phase, bullish traders are left with no choice but to bide their time and wait for the right moment to re-enter the market. Dogecoin has been on a downward trajectory for several months, struggling to surpass major resistance points defined by its moving averages. The 200-day exponential moving average (EMA) continues to hover well above Dogecoin’s current price, signaling a long-term bearish trend.

The overall market conditions for cryptocurrencies have been challenging, with many assets experiencing similar declines. For Dogecoin, its inability to break through resistance levels has only deepened the pessimistic outlook. The cryptocurrency is finding it difficult to regain the momentum it had during its peak in 2021, and unless there is a significant shift in market sentiment, Dogecoin may continue to face downward pressure.

Read more Dogecoin’s Ambitious Roadmap: Pioneering the Future of Digital Currency

In conclusion, while Dogecoin’s trading volume has surged, its price has not followed suit, reflecting the complex dynamics of the cryptocurrency market. Despite strong community support and occasional boosts from influential figures like Elon Musk, Dogecoin’s future remains uncertain, especially as it continues to grapple with bearish market conditions and a lack of widespread commercial adoption. Investors in Dogecoin will need to closely monitor market movements and be prepared for further volatility as the cryptocurrency market remains highly unpredictable.

Important Notice: The content presented in this article is intended for informational purposes only and should not be interpreted as financial advice. Coinshibainu.com bears no responsibility for any investment decisions made relying on the information contained herein. It is highly recommended to consult with a qualified expert or financial advisor before making any investment decisions.